Shari’ah Governance of Islamic Non-Banking Financial Institutions in Malaysia: A Conceptual Review

DOI:

https://doi.org/10.37231/jmtp.2021.2.1.91Keywords:

Shari’ah Governance Framework, Islamic Finance, and Islamic Non-Banking Institution.Abstract

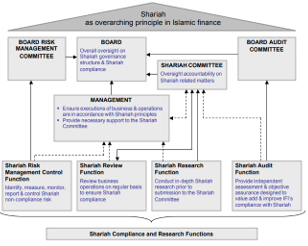

It is widely recognized that Malaysia is among the leading countries in the Islamic banking industry. This is due to its comprehensive regulatory framework from the Shari’ah aspects, particularly Shari’ah governance. Bank Negara Malaysia (BNM), as the regulator, is closely monitoring all players in this industry so that they can follow all its policies and regulations closely. Nevertheless, the Islamic Non-Banking Institutions (NBFIs), seem to be contrary in this aspect. In fact, it is not compulsory for the NBFIs to adhere to the BNM’s policies, particularly regarding the Shari’ah governance framework. Therefore, this study aims to explore Shari’ah governance practices among selected Islamic NBFIs in Malaysia. Since this study is a conceptual review, it adopts library research to achieve its objective. The finding reveals that there are different practices of Shari’ah governance among the Islamic NBFIs due to different sizes of their institutions and the complexity of their products. While the flexibility may bring benefits for the NBFIs, their respective regulators should enhance the Shari’ah governance aspects by providing a comprehensive policy as well as improving its enforcement particularly from the check and balance perspective. Also, the study suggests that the Islamic NBFIs should establish an association among its members to promote coordination, strengthen the governance, and exchange views, particularly on Shari’ah aspects.

Downloads

References

Ahmad Faizal, M. S., Mohammad Hatta, M. F., & Kamis, M. S. (2017). The Attainment of Classical Rulings of Al-Rahn within the Contemporary Islamic Pawn Broking in Malaysia. ASEAN Comparative Education Research Journal on Islam and Civilization (ACER-J), 1(2), 33–52.

Amar, M., & Farid, M. (2010). Monitoring shadow banking and its challenges : the Malaysian experience. The Service Industries Journal, Vol. 32 No(36), 1–28. www.bis.org/ifc/publ/ifcb36g.pdf

Azmir Azri Ahmad, M. S. I. I. (2020). Realizing Maqasid Al-Shari’ah In Shari ah Governance : A Case Study of Islamic Banking Institutions Malaysia. International Journal of Islamic Economics and Finance Research, 3(2), 39–52. Retrieved from https://ijiefer.kuis.edu.my/ircief/article/view/36

Baig, U. (2016). Hajj Management in Pakistan in the Light of Experience of Tabung Haji of Malaysia. International Journal of Islamic Economics and Finance Studies, 2(2), 13–39.

Binti, N., Pusat, A. R., Ekonomi, P., Ekonomi, F., Pengurusan, D., Zaiton, S., Mohd, B., Pusat, D., Razak, A., & Dali, B. M. (2013). Managing Halal and Haram Investment in The Case of EPF’s Malaysia. Johor Bahru, November, 345–354.

BNM. (2011). Financial Stability and Payment System Report.

BNM. (2016). Surveillance of Non-bank FinancialInstitutions - Bank Negara Malaysia. BNM. https://www.bnm.gov.my/-/surveillance-of-non-bank-financial-institutions

Shariah Governance Policy Document, 1 (2019). https://doi.org/10.1016/S0141-6359(03)00004-7

BNM. (2019, June). Shariah Advisory Council (SAC) of Bank Negara Malaysia Compliance of Islamic Pawn Broking Product (Ar-Rahnu). BNM.

EPF. (2017). EPF Annual Report 2017.

EPF. (2018). EPF ’ S Experience In Offering A Shariah-Compliant Scheme. INTERNATIONAL CONFERENCE ON ISLAMIC WEALTH MANAGEMENT & FINANCIAL PLANNING, April, 1–20.

Fadzlan Sufian. (2008). Total Factor Productivity Change in Non-Bank Financial Institutions: Evidence from Malaysia Applying a Malmquist Productivity Index (MPI). Applied Econometrics and International Development, 7(1).

Financial Stability Board (FSB). (2020). Global Monitoring Report on Non-Bank Financial Intermediation 2019. January, 90. www.fsb.org/emailalert

Gabrieli, T., Pilbeam, K., & Shi, B. (2017). The impact of shadow banking on the implementation of Chinese monetary policy. https://doi.org/10.1007/s10368-017-0397-z

Grassa, R. (2015). Shariah supervisory systems in Islamic finance institutions across the OIC member countries: An investigation of regulatory frameworks. Journal of Financial Regulation and Compliance. https://doi.org/10.1108/JFRC-02-2014-0011

Hadiyan, N., Azman, N., Zaidi, M., Zabri, M., Masron, A., Abdul, N., & Malim, K. (2020). The Adoption of Ar-Rahnu and Financial Wellbeing of Micro-entrepreneurs in Malaysia. International Journal of Academic Research in Business and Social Sciences, 10(6), 36–53. https://doi.org/10.6007/IJARBSS/v10-i6/7259

Harith Hamidi, M. I. @ O. (2017). Shariah Governance Practices Of Islamic Credit Co-Operatives In Malaysia [Universiti Sains Islam Malaysia]. http://ddms.usim.edu.my:80/jspui/handle/123456789/16056

Hasan, A. N., Abdul-Rahman, A., & Yazid, Z. (2020). Shariah governance practices at Islamic fund management companies. Journal of Islamic Accounting and Business Research. https://doi.org/10.1108/JIABR-03-2017-0045

Hasan, Z. (2010). Regulatory Framework of Shariah Governance System in Malaysia , GCC Countries and the UK. Kyoto Bulletin of Islamic Area Studies.

Hassan, R., & Hussain, M. A. (2013). Scrutinizing the Malaysian Regulatory Framework on Shari’ah Advisors for Islamic Financial Institutions. Journal of Islamic Finance, Vol 2(No 1), 39–47. https://doi.org/10.12816/0001116

Hassan, R., & Salman, S. A. (2017). Guiding principles in developing Shari’ah governance framework for Islamic capital market. International Journal of Economic Research, 14(6), 27–38.

Iqmal, M., & Kamaruddin, H. (2020). Comparative Analysis on Shariah Governance in Malaysia : SGF 2010 , IFSA 2013 and SGPD 2019. 10(1), 110–131. https://doi.org/10.5296/jpag.v10i1.16157

Ishak, M. S. H. (2011). Tabung Haji as an Islamic Financial Institution for Sustainable Economic Development. 2nd International Conference on Humanities, Historical and Social Sciences, 17, 236–240. http://www.thtech.com.my/construction/project_current.asp

Islam, Mohd Aminul, J. O. (2004). Development Impact of Non-Bank Financial Intermediaries on Economic Growth in Malaysia : An Empirical Investigation. Journal of Business, 2(14), 187–198.

ISRA. (2011). Islamic Financial System Principles & Operations (First Edit). ISRA.

Issyam, M., Hasan, R. B., & Alhabshi, S. M. (2016). Shariah governance framework for islamic co-operatives as an integral social insitution in Malaysia. Intellectual Discourse, 24, 477–500.

Jakim. (2015). Kompilasi Pandangan Hukum Muzakarah Jawatankuasa Fatwa Majlis Kebangsaaan Bagi Hal Ehwal Ugama Islam Malaysia (Edition 5). Jakim.

Khaliq Ahmad, Mustafa Omas Mohhamed, & Dzuljastri Abdul Razak. (2012). Case of Pilgrimage Funds Management Board. IIUM Journal of Case Studies in Asian Management, 3(2), 17–31. https://doi.org/10.1142/9789814508988

Khiyar, K. A. (2012). Malaysia: 30 Years of Islamic Banking Experience (1983-2012). International Business & Economics Research Journal (IBER), 11(10), 1133. https://doi.org/10.19030/iber.v11i10.7259

Laldin, M. A., & Furqani, H. (2018). Islamic Financial Services Act (IFSA) 2013 and the Sharīʿah-compliance requirement of the Islamic finance industry in Malaysia. ISRA International Journal of Islamic Finance, 10(1), 94–101. https://doi.org/10.1108/IJIF-12-2017-0052

Muhamad Amar. (2013). Monitoring Shadow Banking And Its Challenges: The Malaysian Experience (Issue November).

Nawal, K., Sheila, N. N., & Syed Ahmed, S. (2013). Shariah governance for Islamic capital market: A step forward. International Journal of Education and Research, 1(6), 1–14.

Nurhasanah, N. (2015). Tabung Haji Malaysia Dalam Perspektif Ekonomi. Al-Iqtishad: Journal of Islamic Economics, 3(2), 179–192. https://doi.org/10.15408/aiq.v3i2.2520

Ongeri, G. M. (2014). The Effect of Macroeconomic Variables On The Financial Performance Of Non-Bank Financial Institutions In Kenya (Issue October) [University of Nairobi]. https://a-chss.uonbi.ac.ke/sites/default/files/chss/Godfrey Mageto -Msc-Fin Project.pdf

PNB. (2019). Annual Report 2019. Retrieved January 15, 2021, from https://www.pnb.com.my/pdf/AnnualReport/AR2019-EN/#book/

Puad, N. A. bt M., Rafdi, N. bt J., Sanusi, S. W. S. bt A., & Shahar, W. S. S. bt. (2017). A Review on Development Financial Institutions in Malaysia. 4th International Conference on Management and Muamalah 2017, 2017(4th ICoMM 2017), 978–967. http://conference.kuis.edu.my/icomm/4th/eproceedings/IC 043.pdf

Rahman, R. A., Rahman, A., Ghani, E. K., & Omar, N. H. (2019). Government-linked investment companies and real earnings management: Malaysian evidence. International Journal of Financial Research, 10(3), 299–313. https://doi.org/10.5430/IJFR.V10N3P299

Razinah, N., Zain, M., & Kassim, S. (2017). Shariah Governance in Islamic Wealth Management : A Learning Lesson from Securities Commission Malaysia The 5th ASEAN International Conference on Islamic Finance. International Conference on Islamic Finance, 5th(January), 3–16.

Sa’ri, Joni Tamkin, C. Z. (2005). The Role of Tabung Haji As A Deposit Mobilizer Of Muslims In Malaysia: 1969-1990: Historical Approach. Jurnal Al-Tamaddun, 1, 215–234.

Guidelines On Islamic Fund Management, 1 (2007).

Registration of Shariah Advisers Guideline, 1 (2009).

Shah, A. A., & Sharif, D. (2017). Penasihat Syariah di Penyedia Perkhidmatan Ar Rahnu: Tinjauan Semula Terhadap Garis Panduan & Pelaksanaan. Jurnal Muamalat, 10, 1–17.

Garis Panduan Tadbir Urus Syariah Tujuan, 1 (2015).

Suhaini Abdul Majid, M., Zuraina Mir Ahmad Talaat, A., Zaid Zulkifli, M., & Shaiza Mir Ahmad Talaat, N. (2016). Tabung Haji Malaysia as a World Role Model of Islamic Management Institutions. In International Journal of Business and Management Invention ISSN (Vol. 5). Online. www.ijbmi.org

The Edge. (2016). Bank Negara issues warning to Tabung Haji | The Edge Markets. https://www.theedgemarkets.com/article/bank-negara-issues-warning-tabung-haji

Wan Amir Shafiq bn Ab. Nasir, Rusni Hassan, I. M. T. (2020). Malaysian’s Government Linked Investment Companies: Is There a Need for Shariah Governance Framework? Journal of Islam in Asia, 17(2).

Zabala, C. A., & Josse, J. M. (2018). Shadow credit in the middle market: the decade after the financial collapse. Journal of Risk Finance, 19(5), 414–436. https://doi.org/10.1108/JRF-02-2017-0033