Conventional Versus Sharia Money Market Mutual Funds: Which Performs Better During the Covid-19 Pandemic?

DOI:

https://doi.org/10.37231/jmtp.2020.2.3.174Keywords:

Money Market Mutual fund performance, pandemic covid-19, Conventional Money Market Mutual Fund, Sharia Money Market Mutual FundAbstract

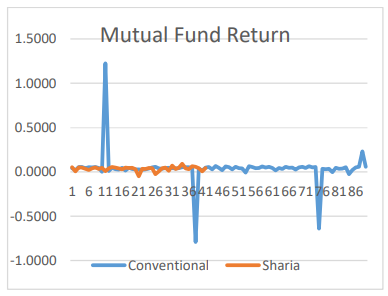

This study aims to determine whether conventional money market mutual funds perform better than sharia money market mutual funds or vice versa during the COVID-19 pandemic in Indonesia. This research method is descriptive with a quantitative comparison approach. This study employed secondary data obtained from IDX, Indonesian Bank, and Pasar Dana website. The research employed the money market mutual funds data, Net Asset Value, BI 7 Days Repo rate during year 2020. Sharpe ratio utilized in this research to determine the money market mutual funds performance. Then, the result compared by using Independent sample T-test on SPSS. The result uncovers that in general the performance of conventional money market mutual funds performance superior the sharia money market mutual funds performance during covid-19 in Indonesia. However, both mutual funds average Sharpe ratio show the negative number during 2020. Moreover, there are no significant difference between conventional and sharia money market mutual funds returns during the period 2020. The high different return on the maximum return due to some conventional mutual fund perform exceptional during 2020.

Downloads

References

CNN. (2020). kinerja reksa dana saham amblas 2846 persen di tengah corona.

Esha, M. R., Heykal, M., & Indrawati, T. (2014). Analisis Perbandingan Reksa Dana Saham Syariah dengan Reksa Dana Saham Konvensional Periode 2009–2012. Binus Business Review, 5(1), 230-240.

Huda, N., Nazwirman, N., & Hudori, K. (2017). Analisis Perbandingan Kinerja Reksa Dana Saham Syariah Dan Konvensional Periode 2012-2015. Iqtishadia: Jurnal Kajian Ekonomi dan Bisnis Islam STAIN Kudus, 10(2), 184-209.

Indonesia, I. B. (2017). Wealth management: Tata kelola: Gramedia Pustaka Utama.

Iswanaji, C. (2016). Perbandingan Kinerja Reksadana Syariah Dan Reksadana Konvensional Ditinjau Berdasarkan Tingkat Risk And Return. Media Ekonomi dan Manajemen, 31(2).

Keown, A. J., Scott, D. F., Martin, J. D., & Petty, J. W. (2001). Dasar-dasar manajemen keuangan. Jakarta: salemba empat.

Khalisa, Z. (2018). Analisis Perbandingan Kinerja Reksa dana Konvensional dan Reksa Dana Syariah Berdasarkan Metode Sharpe, Treynor, dan Jensen Tahun 2014-2016.

Lailiyah, E. H., & Sulasmiyati, S. (2016). Analisis Perbandingan Kinerja Reksadana Syariah dan Reksadana Konvensional (Studi pada Reksadana yang Terdaftar di Otoritas Jasa Keuangan Periode 2012-2016). Jurnal Administrasi Bisnis, 35(2), 114-121.

Law, of, the, Republic, of, & Indonesia. (1995). Concerning the Capital Market. In.

Lestari, W. R. (2015). Kinerja Reksadana Saham Syariah dan Reksadana Saham Konvensional. Jurnal Manajemen Magister Darmajaya, 1(01), 116-128.

Ratnawati, V., & Khairani, N. (2012). Perbandingan Kinerja Reksa Dana Syariah dan Reksa Dana Konvensional. Jurnal Akuntansi (Media Riset Akuntansi & Keuangan), 1(1), 96-113.

Sari, N. I., & Riwayati, H. E. (2021). Analisis Perbedaan Kinerja Reksa Dana Saham Konvensional Dengan Reksa Dana Saham Syariah. Paper presented at the Prosiding Seminar Nasional.

Sharpe, W. F. (1966). Mutual fund performance. The Journal of business, 39(1), 119-138.

Sugiyono. (2008). Metode Penelitian Kuantitatif Kualitatif dan R&D. CV. Alfabeta, Bandung.

Sunaryo, D., & S MB, M. (2019). Manajemen investasi dan portofolio: CV. Penerbit Qiara Media.

Umam, K., & Sutanto, H. (2017). Manajemen investasi. In: Pustaka Setia.

Wuryandani, D. (2020). Dampak pandemi Covid-19 terhadap pertumbuhan ekonomi Indonesia 2020 dan solusinya. Info Singkat Bidang Ekonomi Dan Kebijakan Publik Pusat Penelitian Badan Keahlian DPR RI, 12(15), 19-24.

Zamzany, F. R., & Setiawan, E. (2018). Studi Komparatif Kinerja Reksadana Saham Konvensional dan Syariah Di Indonesia. Akuntabilitas: Jurnal Ilmu Akuntansi, 11(2), 305-318.