An Asymmetric Effect of Economic Growth, Foreign Direct Investment and Financial Development on the Quality of Environment in Nigeria

DOI:

https://doi.org/10.37231/jmtp.2020.1.1.6Keywords:

Environmental Quality, Economic Growth, Financial development, FDI, Asymmetric, Non-Linear ARDLAbstract

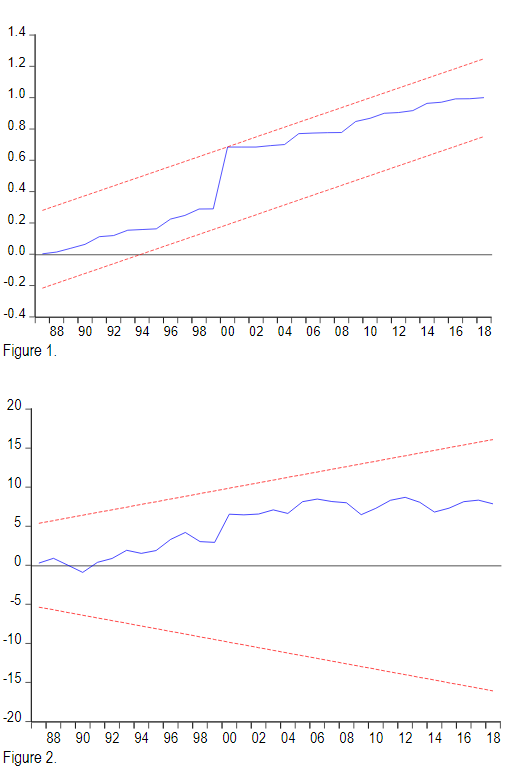

The study looks at the asymmetric impact of macroeconomic variables on quality of environment in Nigeria. The analysis incorporates data from the annual time series covering the 1970-2018 periods and applies the non-linear ARDL method for the empirical analysis. The findings show that negative and positive GDP escalates the quantity of carbon emissions, thereby worsening environmental sustainability. Through positive as well as negative shocks, FD leads to carbon emissions and FDI increases carbon emissions through positive shocks and decreases them by negative shocks. The positive shock from the FDI increases the CO2 emissions in Nigeria, resulting in environmental degradation. The research suggests implementing technology to promote the productive use of resources that would help boost environmental efficiency, increase long-run productivity and save energy. The lenders will ease financing for the energy sector and devote financial resources to ecologically friendly companies, rather than investing them in financing customers. FDI inflows should be tracked to curb CO2 emissions.

Downloads

References

Abbasi, F., & Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy, 90, 102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Abdouli, M., Kamoun, O., & Hamdi, B. (2018). The impact of economic growth, population density, and FDI inflows on CO 2 emissions in BRICTS countries: Does the Kuznets curve exist? Empirical Economics, 54(4), 1717–1742. https://doi.org/10.1007/s00181-017-1263-0

Acheampong, A. O. (2018). Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Economics, 74, 677–692. https://doi.org/10.1016/j.eneco.2018.07.022

Acheampong, A. O., & Boateng, E. B. (2019). Modelling carbon emission intensity: Application of artificial neural network. Journal of Cleaner Production, 225, 833–856. https://doi.org/10.1016/j.jclepro.2019.03.352

Ahmad, N., Du, L., Lu, J., Wang, J., Li, H. Z., & Hashmi, M. Z. (2017). Modelling the CO2 emissions and economic growth in Croatia: Is there any environmental Kuznets curve? Energy, 123, 164–172. https://doi.org/10.1016/j.energy.2016.12.106

Al-Mulali, U., & Ozturk, I. (2016). The investigation of environmental Kuznets curve hypothesis in the advanced economies: The role of energy prices. Renewable and Sustainable Energy Reviews, 54, 1622–1631. https://doi.org/10.1016/j.rser.2015.10.131

Al-Mulali, U., Ozturk, I., & Lean, H. H. (2015). The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Natural Hazards, 79(1), 621–644. https://doi.org/10.1007/s11069-015-1865-9

Al-mulali, U., Saboori, B., & Ozturk, I. (2015). Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy, 76, 123–131. https://doi.org/10.1016/j.enpol.2014.11.019

Apergis, N., & Ozturk, I. (2015). Testing environmental Kuznets curve hypothesis in Asian countries. Ecological Indicators, 52, 16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Atasoy, B. S. (2017). Testing the environmental Kuznets curve hypothesis across the U.S.: Evidence from panel mean group estimators. Renewable and Sustainable Energy Reviews, 77(April), 731–747. https://doi.org/10.1016/j.rser.2017.04.050

Atil, A., Bouheni, F. Ben, Lahiani, A., & Shahbaz, M. (2019). Factors influencing CO2 Emission in China: A Nonlinear Autoregressive Distributed Lags Investigation. (91190), 1–28.

Aye, G. C., & Edoja, P. E. (2017). Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Economics and Finance, 5(1), 1–22. https://doi.org/10.1080/23322039.2017.1379239

Begum, R. A., Sohag, K., Abdullah, S. M. S., & Jaafar, M. (2015). CO2 emissions, energy consumption, economic and population growth in Malaysia. Renewable and Sustainable Energy Reviews, 41, 594–601. https://doi.org/10.1016/j.rser.2014.07.205

Bokpin, G. A. (2017). Foreign Direct Investment and Environmental Sustainability in Africa: The Role of Institutions and Governance Foreign Direct Investment and Environmental Sustainability in Africa: The Role of Institutions and Governance. Research in International Business and Finance, 39(9), 239–247. https://doi.org/10.1016/j.ribaf.2016.07.038

Boufateh, T. (2019). The environmental Kuznets curve by considering asymmetric oil price shocks: evidence from the top two. Environmental Science and Pollution Research, 26(1), 706–720. https://doi.org/10.1007/s11356-018-3641-3

Charfeddine, L., & Mrabet, Z. (2017). The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renewable and Sustainable Energy Reviews, 76(February), 138–154. https://doi.org/10.1016/j.rser.2017.03.031

Cosmas, N. C., Chitedze, I., & Mourad, K. A. (2019). An econometric analysis of the macroeconomic determinants of carbon dioxide emissions in Nigeria. Science of the Total Environment, 675, 313–324. https://doi.org/10.1016/j.scitotenv.2019.04.188

Dar, J. A., & Asif, M. (2017). Is financial development good for carbon mitigation in India? A regime shift-based cointegration analysis. Carbon Management, 8(5–6), 435–443. https://doi.org/10.1080/17583004.2017.1396841

Dogan, E., & Seker, F. (2016). The in fl uence of real output , renewable and non-renewable energy , trade and fi nancial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Dong, K., Sun, R., & Dong, X. (2018). CO2 emissions, natural gas and renewables, economicgrowth: Assessing the evidence from China. Science of the Total Environment, 640–641, 293–302. https://doi.org/10.1016/j.scitotenv.2018.05.322

Eleri, E. O., Onuvae, P., & Ugwu, O. (2013). Low-carbon energy development in Nigeria. International Institute for Environment and Development, 1(1), 2–24. Retrieved from http://pubs.iied.org/pdfs/G03555.pdf

Epa, U. (2017). EPA Year in Review 2017-2018 report.Farhani, S., & Ozturk, I. (2015). Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environmental Science and Pollution Research, 22(20), 15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Ghorashi, N., & Rad, A. A. (2018). Impact of Financial Development on CO 2 Emissions: Panel Data Evidence from Iran’s Economic Sectors. Journal of Community Health Research, 7(2), 127–133.

Gokmenoglu, K. K., & Sadeghieh, M. (2019). Financial Development, CO 2 Emissions, Fossil Fuel Consumption and Economic Growth: The Case of Turkey.Strategic Planning for Energy and the Environment, 38(4), 7–28. https://doi.org/10.1080/10485236.2019.12054409

Hao, Y., & Liu, Y. M. (2015). Has the development of FDI and foreign trade contributed to China’s CO2 emissions? An empirical study with provincial panel data. Natural Hazards, 76(2), 1079–1091. https://doi.org/10.1007/s11069-014-1534-4

Haseeb, A., Xia, E., Danish, Baloch, M. A., & Abbas, K. (2018). Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environmental Science and Pollution Research, 25(31), 31283–31296. https://doi.org/10.1007/s11356-018-3034-7

Haug, A. A., & Ucal, M. (2019). The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Economics, 81, 297–307. https://doi.org/10.1016/j.eneco.2019.04.006

Heidari, H., Katircioǧlu, S. T., & Saeidpour, L. (2015). Economic growth, CO2 emissions, and energy consumption in the five ASEAN countries. International Journal of Electrical Power and Energy Systems, 64, 785–791. https://doi.org/10.1016/j.ijepes.2014.07.081

Hille, E., Shahbaz, M., & Moosa, I. (2019). PT. Energy Economics, 81(4), 308–326. https://doi.org/10.1016/j.eneco.2019.04.004

Hitam, M. Bin, & Borhan, H. B. (2012). FDI, Growth and the Environment: Impact on Quality of Life in Malaysia. Procedia -Social and Behavioral Sciences, 50(July), 333–342. https://doi.org/10.1016/j.sbspro.2012.08.038

Ibrahim, M. H. (2015). Oil and food prices in Malaysia: a nonlinear ARDL analysis. Agricultural and Food Economics, 3(1). https://doi.org/10.1186/s40100-014-0020-3

Jakada, A. H., Mahmood, S., Ahmad, A. U., Farouq, I. S., & Mustapha, U. A. (2020). Financial Development and the Quality of the Environment in Nigeria: An Application of Non-Linear ARLD Approach. Research in World Economy, 11(1), 78–92. https://doi.org/10.5430/rwe.v11n1p78

Jiang, R., Zhou, Y., & Li, R. (2018). Moving to a low-carbon economy in China: Decoupling and decomposition analysis of emission and economy from a sector perspective. Sustainability (Switzerland), 10(4). https://doi.org/10.3390/su10040978

Katircioğlu, S. T., & Taşpinar, N. (2017). Kuznets curve: Empirical evidence from Turkey crossmark. Renewable and Sustainable Energy Reviews, 68(February 2015), 572–586. https://doi.org/10.1016/j.rser.2016.09.127

Lau, L. S., Choong, C. K., & Eng, Y. K. (2014). Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: DO foreign direct investment and trade matter? Energy Policy, 68, 490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Liddle, B. (2015). What are the carbon emissionselasticities for income and population? Bridging STIRPAT and EKC via robust heterogeneous panel estimates. Global Environmental Change, 31(61304), 62–73. https://doi.org/10.1016/j.gloenvcha.2014.10.016

Liu, Q., Wang, S., Zhang, W., Zhan, D., & Li, J. (2018). Does foreign direct investment affect environmental pollution in China’s cities? A spatial econometric perspective. Science of the Total Environment, 613–614, 521–529. https://doi.org/10.1016/j.scitotenv.2017.09.110

Ma, X., & Jiang, Q. (2019). How to Balance the Trade-off between Economic Development and Climate Change? Sustainability, 11(1638), 1–29. https://doi.org/10.3390/su11061638

Omri, A., Daly, S., Rault, C., & Chaibi, A. (2015). Financial development , environmental quality , trade and economic growth: What causes what in MENA countries ☆. Energy Economics, 48, 242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Ozcan, B. (2013). The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy, 62, 1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Özokcu, S., & Özdemir, Ö. (2017). Economic growth, energy, and environmental Kuznets curve. Renewable and Sustainable Energy Reviews, 72(November 2016), 639–647. https://doi.org/10.1016/j.rser.2017.01.059

Ozturk, I., & Acaravci, A. (2010). The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL bound testing approach. Applied Energy, 87(6), 1938–1943. https://doi.org/10.1016/j.apenergy.2009.10.010

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pao, H. T., & Tsai, C. M. (2011). Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy, 36(5), 2450–2458. https://doi.org/10.1016/j.energy.2011.01.032

Paramati, S. R., Alam, M. S., & Apergis, N. (2018). The role of stock markets on environmental degradation: A comparative study of developed and emerging market economies across the globe. Emerging Markets Review, 35, 19–30. https://doi.org/10.1016/j.ememar.2017.12.004

Park, J., & Hong, T. (2013). Analysis of South Korea’s economic growth, carbon dioxide emission, and energy consumption using the Markov switching model. Renewable and Sustainable Energy Reviews, 18, 543–551. https://doi.org/10.1016/j.rser.2012.11.003

Park, Y., Meng, F., & Baloch, M. A. (2018). The effect of ICT , financial development , growth , and trade openness on CO 2 emissions: an empirical analysis. Environmental Science and Pollution Research, 25, 30708–30719

.Pazienza, P. (2015). The relationship between CO2 and Foreign Direct Investment in the agriculture and fishing sector of OECD countries: Evidence and policy considerations. Intellectual Economics, 9(1), 55–66. https://doi.org/10.1016/j.intele.2015.08.001

Pesaran, M. H., Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association, 94(446), 621–634. https://doi.org/10.1080/01621459.1999.10474156

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing Approches to Analysis of Long Run Relationships. Journal of Applied Econometrics, 16(3), 289–326.

Raza, S. A., & Shah, N. (2018). Impact of Financial Development, Economic Growth and Energy Consumption On Environmental Degradation: Evidence from Pakistan. (87095).

Saud, S., Chen, S., & Haseeb, A. (2019). Impact of financial development and economic growth on environmental quality: an empirical analysis from Belt and Road Initiative ( BRI ) countries. Environmental Science and Pollution Research, 26, 2253–2269.

Sehrawat, M., Giri, A. K., & Mohapatra, G. (2015). The impact of financial development, economic growth and energy consumption on environmental degradation: Evidence from India. Management of Environmental Quality: An International Journal, 26(5), 666–682. https://doi.org/10.1108/MEQ-05-2014-0063

Seker, F., Ertugral, H. M., & Cetin, M. (2015). The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renewable and Sustainable Energy Reviews, 52, 347–356. https://doi.org/10.1016/j.rser.2015.07.118

Shahbaz, M., Shahzad, S. J. H., Ahmad, N., & Alam, S. (2016). Financial development and environmental quality: The way forward. In Energy Policy(Vol. 98). https://doi.org/10.1016/j.enpol.2016.09.002

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. SSRN Electronic Journal, 1–61. https://doi.org/10.2139/ssrn.1807745

Sulaiman, C., & Abdul-Rahim, A. S. (2018). Population Growth and CO 2 Emission in Nigeria: A Recursive ARDL Approach. SAGE Journals, 8(2), 1–14. https://doi.org/10.1177/2158244018765916

Sung, B., Song, W., & Park, S. (2017). SC. Economic Systems, 42(2), 320–331. https://doi.org/10.1016/j.ecosys.2017.06.002

Tamazian, A., Chousa, J. P., & Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy, 37(1), 246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang, C. F., & Tan, B. W. (2015). The impact of energy consumption , income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy, 79, 447–454. https://doi.org/10.1016/j.energy.2014.11.033

Yazdi, S. K., & Beygi, E. G. (2017). The dynamic impact of renewable energy consumption and financial development on CO 2 emissions: For selected African countries. Energy Sources, Part B: Economics, Planning, and Policy, 00(00), 1–8. https://doi.org/10.1080/15567249.2017.1377319

Yeh, J. C., & Liao, C. H. (2017). Impact of population and economic growth on carbon emissions in Taiwan using an analytic tool STIRPAT. Sustainable Environment Research, 27(1), 41–48. https://doi.org/10.1016/j.serj.2016.10.001

Zafar, M. W., Saud, S., & Hou, F. (2019). The impact of globalization and financial development on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development ( OECD ). Environmental Science and Pollution Research, 26(8), 13246–13262.

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., & Hou, F. (2019a). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production, 228, 533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., & Hou, F. (2019b). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production, 22(8), 533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zakarya, G. Y., Mostefa, B., Abbes, S. M., & Seghir, G. M. (2015). Factors Affecting CO2 Emissions in the BRICS Countries: A Panel Data Analysis. Procedia Economics and Finance, 26(May), 114–125. https://doi.org/10.1016/S2212-5671(15)00890-4

Zeng, K., &Eastin, J. (2012). Do Developing Countries Invest Up? The Environmental Effects of Foreign Direct Investment from Less-Developed Countries. World Development, 40(11), 2221–2233. https://doi.org/10.1016/j.worlddev.2012.03.008

Zhang, C., & Zhou, X. (2016). Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renewable and Sustainable Energy Reviews, 58, 943–951. https://doi.org/10.1016/j.rser.2015.12.226

Zhu, H., Duan, L., Guo, Y., & Yu, K. (2016). The effects of FDI , economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Economic Modelling, 58, 237–248. https://doi.org/10.1016/j.econmod.2016.05.003