An Empirical Evidence of the Value Relevance and Timeliness of Financial Reports in the Post Adoption of IFRS in Nigeria

DOI:

https://doi.org/10.37231/jmtp.2021.2.1.72Keywords:

Financial reporting quality, IFRS adoption, value relevance, timely loss recognition, NigeriaAbstract

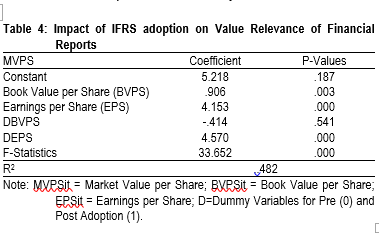

The emergencies of the globalization of accounting standards and other critical issue have been reported to reduce the cost of enhancing comparability, understandability, and producing supplementary information, and analysis of the accounting reports. This allowed many developing nations who do not want to be left behind to take a cue from the world's major economies to meet the international financial reporting standards (IFRS) that Nigeria has taken measures to converge equally. The study examines the effect of IFRS adoption on financial reporting quality of listed non-financial companies in the Nigerian stock exchange. Particularly, in the area of value relevance and timely loss recognition. The study used 63 non-financial companies’ annual reports listed on the Nigerian Stock Exchange (NSE) for the period of 2008 to 2018 (i.e., 5years pre-adoption and 5years post adoption). Multiple linear regression was used in analyzing the collected data via STATA software. The result shows a significant increase in the value relevance of financial reports after IFRS adoption. The study also showed that the identification of significant losses increased in the post-IFRS adoption era. Based on the result, the study suggests that the relationship between accounting measures on IFRS adoption and financial reporting quality indicates that both foreign and local investors can predict the future of market value of individual securities. Therefore, investor receives considerable information by knowing the price information on time that shows more value relevant. Finally, this study contributed to the theory and practice, as well as direction for further studies related to the financial reporting standards and the reporting quality.

Downloads

References

Abang’a, A. O. G. (2017). Determinants of quality of financial reporting among semi-autonomous government agencies in Kenya (Doctoral dissertation, Strathmore University).

Abata, M. A. (2015). The impact of International Financial Reporting Standards (IFRS) adoption on financial reporting practice in the Nigerian banking sector. Journal of Policy and Development Studies. 9(2), 169 – 184. https://doi.org/10.12816/0011215

Adetoso, J. A. & Oladeje, K. S. (2013). The Relevance of International Financial Reporting Standards in the Preparation and Presentation of Financial Statements in Nigeria. Research Journal of Finance and Accounting, 4(7), 191-197. https://doi.org/10.1002/978111887 0372ch3

Adeuja, Y. O. (2015). A Comparative Approach to the Impact of IFRS (International Financial Reporting Standards) on the Performance of Banks in Nigeria. Thesis for the degree of Master of Science in Banking and Finance, Institute of Graduate Studies and Research, Eastern Mediterranean University , Gazimağusa, North Cyprus. https://doi.org/10.1002/9781119197690.ch32

Afsheena, P., & Santhakumar, S. (2020). Timeliness and persistence of conservative earnings in an emerging market. Journal of Financial Reporting and Accounting. https://doi.org/10.1108/jfra-12-2018-0116

Al Daoud, K. A., Ismail, K. N. I. K., & Lode, N. A. (2015). The Impact of Internal Corporate Governance on the Timeliness of Financial Reports of Jordanian Firms: Evidence using Audit and Management Report Lags. Mediterranean Journal of Social Sciences, 6(1), 430-442. https://doi.org/10.5901/mjss.2015.v6n1p430

Albu, N., Albu, C. N., & Gray, S. J. (2020). Institutional factors and the impact of international financial reporting standards: the Central and Eastern European experience. In Accounting Forum (pp. 1-31). Routledge. https://doi.org/10.1080/01559982.2019.1701793

Al-Dmour, A., Abbod, M., & Al-Balqa, N. (2018). The impact of the quality of financial reporting on non-financial business performance and the role of organizations demographic'attributes (type, size and experience). https://doi.org/10.24818/jamis.2018.01004

Amidu, M., & Issahaku, H. (2019). Do globalisation and adoption of IFRS by banks in Africa lead to less earnings management? Journal of Financial Reporting and Accounting, 17(2), 222-248. https://doi.org/10.1108/jfra-05-2017-0035

Azobi, C. (2010). Preparation of Financial Statements: Challenges of Adopting IFRS and IPSA. Being a paper presented at ICAN interactive session for Accountants in education on March, Lagos 18, 10. https://doi.org/10.1142/9789814280242_0014

Bala, M. (2013). Effects of IFRS Adoption on the Financial Reports of Nigerian Listed Entities: The Case of Oil and Gas Companies. The Macro theme Review 2 (7), 9-26. https://doi.org/10.5296/ajfa.v9i1.11407

Ball, R. (2001). Infrastructure Requirements for an Economically Efficient System of Public Financial Reporting and Disclosure. Brookings-Wharton papers on financial services, 2001(1), 127-169. https://doi.org/10.1353/pfs.2001.0002

Ball, R., Robin, A., & Sadka, G. (2006). Are Timeliness and Conservatism Due to Debt or Equity Markets? An International Test of “Contracting” and “Value Relevance” Theories of Accounting. Manuscript, University of Chicago. https://doi.org/10.1080/09638180601102198

Ball, R., Robin, A., & Wu, J. S. (2003). Incentives versus standards: properties of accounting income in four East Asian countries. Journal of Accounting and Economics, 36(1–3), 235–270. http://doi.org/10.1016/j.jacceco.2003.10.003.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467– 498. http://doi.org/10.1111/j.1475-679X.2008.00287.x

Barton, J., B. Hansen & Pownall, G. (2010). Which Performance Measures Do Investors Value the Most and Why? The Accounting Review, 85, (3), 753-789. https://doi.org/10.2139/ssrn.1371265

Bilgic, F. A. & İbis, C. (2013). Effects of New Financial Reporting Standards on Value Relevance: A Study about Turkish Stock Markets. International Journal of Economics and Finance, 5(10), 126-140.

Chalaki, P., Didar, H., & Riahinezhad, M. (2012). Corporate Governance Attributes and Financial Reporting Quality: Empirical Evidence from Iran. International Journal of Business and Social Science, 3(15), 223-229 https://doi.org/10.2139/ssrn.2141768

Chua, Y. L., Cheong, C. S., & Gould, G. (2012). The impact of mandatory IFRS adoption on accounting quality: Evidence from Australia. Journal of International Accounting Research, 11(1), 119-146. https://doi.org/10.2308/jiar-10212

Chychyla, R., Leone, A. J., & Minutti-Meza, M. (2019). Complexity of financial reporting standards and accounting expertise. Journal of Accounting and Economics, 67(1), 226-253. https://doi.org/10.1016/j.jacceco. 2018.09.005

Damak-Ayadi, S., Sassi, N., & Bahri, M. (2020). Cross-country determinants of IFRS for SMEs adoption. Journal of Financial Reporting and Accounting, 18(1), 147-168. https://doi.org/10.1108/jfra-12-2018-0118

Dimitropoulos, P. E., Asteriou, D., Kousenidis, D., & Leventis, S. (2013). The impact of IFRS on accounting quality: Evidence from Greece. Advances in Accounting, 29(1), 108–123. http://doi.org/10.1016/j.adiac.2013 .01.002.

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the Corporation: Concepts, evidence, and implications. Academy of Management Review, 20(1), 65-91. https://doi.org/10.5465/amr.1995. 9503271992

Echobu, J., Okika, N. P., & Mailafia, L. (2017). Determinants of financial reporting quality : Evidence from listed agriculture and natural resources firms in Nigeria. International Journal of Accounting Research, 3(2), 20-31. https://doi.org/10.12816/0041759

Edogbanya, A., & Kamardin, H. (2014). Adoption of international financial reporting standards in Nigeria: Concepts and issues. Journal of Advanced Management Science, 2(1), 72-75. https://doi.org/10.12720/joams.2.1.72-75

El-Bannany, M. (2018). Financial reporting quality for banks in Egypt and the UAE. Corporate Ownership and Control, 15, 116-131. https://doi.org/10.22495/cocv15i2art10

El-Helaly, M., Ntim, C. G., & Al-Gazzar, M. (2020). Diffusion theory, national corruption and IFRS adoption around the world. Journal of International Accounting, Auditing and Taxation, 38, 100305. https://doi.org/10.1016/j.intaccaudtax.2020.100305

Ezat, A., & El‐Masry, A. (2008). The impact of corporate governance on the timeliness of corporate internet reporting by Egyptian listed companies. Managerial Finance, 34(12), 848-867. https://doi.org/10.1108/03074350810915815

Hlel, K., Kahloul, I., & Bouzgarrou, H. (2020). IFRS adoption, corporate governance and management earnings forecasts. Journal of Financial Reporting and Accounting, 18(2), 325-342. https://doi.org/10.1108/jfra-01-2019-0007

Houqe, M. N., Van Zijl, T., Dunstan, K., & Karim, A. W. (2012). The effect of IFRS adoption and investor protection on earnings quality around the world. The International Journal of Accounting, 47(3), 333-355. https://doi.org/10.1016/j.intacc.2012.07.003

IASB (2008). Exposure Draft on an Improved Conceptual Framework for Financial Reporting: The Objective of Financial Reporting and Qualitative Characteristics of Decision-useful Financial Reporting Information. London.

Irvine, H. (2008). The global institutionalization of financial reporting: The case of the United Arab Emirates. Accounting Forum, 32(2), 125-142. https://doi.org/10.1016/j.accfor.2007.12.003

Iyoha, F. O. (2012). Company Attributes and the Timeliness of Financial Reporting in Nigeria. Business Intelligence Journal, 5(1), 41-49.

Ma, C., Zhang, J., & Du, H. (2013). Chinese accounting restatement and the timeliness of annual report. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2244655

Judge, W., Li, S., & Pinsker, R. (2010). National adoption of international accounting standards: An institutional perspective. Corporate Governance: An International Review, 18(3), 161-174. https://doi.org/10.1111/j.1467-8683.2010.00798.x

Kargin, S. (2013). The impact of IFRS on the value relevance of accounting information: Evidence from Turkish firms. International Journal of Economics and Finance, 5(4). https://doi.org/10.5539/ijef.v5n4p71

Kibiya, M. U., Che Ahmad, A., & Amran, N. A. (2016). Financial reporting quality, does regulatory changes matter? Evidence from Nigeria. Asian Journal of Multidisciplinary Studies, 4(12), 112-118. https://doi.org/10.15405/epsbs.2016.08.106

Kim, O. (2013). Russian accounting system: Value relevance of reported information and the IFRS adoption perspective. The International Journal of Accounting, 48(4), 525–547. http://doi.org/10.1016/j.intacc. 2013.10.007

Kyari, A. K. (2019). Impact of IFRS Adoption on Value Relevance of Financial Statements. FULafia Journal of Social Sciences, 2(1), 47-56.

Kythreotis, A. (2014). Measurement of Financial Reporting Quality Based on IFRS Conceptual Framework’s Fundamental Qualitative Characteristics. European Journal of Accounting, Finance and Business, 2(3), 4-29. https://doi.org/10.2139/ssrn.2356403

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: an international comparison. Journal of Financial Economics, 69(3), 505–527. http://doi.org/http://dx.doi.org/10. 1016/S0304-405X(03)00121-1.

Maigoshi, Z., S. (2017). Related party transaction disclosure: compliance, determinants, value-relevance and real earnings management in Nigeria. (Doctoral thesis from Universiti Utara Malaysia). https://doi.org/10.15405/epsbs.2016.08.8

Mehrabanpour, M., Faraji, O., Sajadpour, R., & Alipour, M. (2020). Financial statement comparability and cash holdings: The mediating role of disclosure quality and financing constraints. Journal of Financial Reporting and Accounting, 18(3), 615-637. https://doi.org/10.1108/jfra-12-2019-0167

Mantzari, E., Sigalas, C., & Hines, T. (2017). Adoption of the international financial reporting standards by Greek non-listed companies: The role of coercive and hegemonic pressures. Accounting Forum, 41(3), 185-205. https://doi.org/10.1016/j.accfor.2017.04.003

Maroun, W., & Van Zijl, W. (2016). Isomorphism and resistance in implementing IFRS 10 and IFRS 12. The British Accounting Review, 48(2), 220-239. https://doi.org/10.1016/j.bar.2015.07.003

Mohamed, W., Yasseen, Y., & Nkhi, N. (2020). International financial reporting standards for small and medium-sized entities: A survey showing insights of South African accounting practitioners. Journal of Economic and Financial Sciences, 13(1). https://doi.org/10. 4102/jef.v13i1.489

Firoz, C. M., & Ansari, A. A. (2010). Environmental accounting and international financial reporting standards (IFRS). International Journal of Business and Management, 5(10). https://doi.org/10 .5539/ijbm.v5n10p105

Musa, A. (2015). International financial reporting standards and financial reporting quality among Nigerian listed companies (Doctoral dissertation, Universiti Utara Malaysia). https://doi.org/10.46281/ijafr.v1i1.13

Musa, A., & Muhammad Tanimu, I. (2017). International Financial Reporting Standards and Value Relevance of Financial Information: An Empirical Evaluation of Selected Nigerian Listed Companies. International Journal of Accounting & Finance Review, 1(1), 1-11. https://doi.org/10.46281/ijafr.v1i1.13.

OHLSON, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661-687. https://doi.org/10.1111/j.1911-3846.1995.tb00461.x

Olowokure, O. A., Tanko, M., & Nyor, T. (2016). Firm structural characteristics and financial reporting quality of listed deposit money banks in Nigeria. International Business Research, 9(1), 106.

Paglietti, P. (2010). Earnings management, timely loss recognition and value relevance in Europe following the IFRS mandatory adoption: evidence from Italian listed companies. Economia Aziendale Online, 4, 97–117.

Palea, V. (2013). IAS/IFRS and financial reporting quality: Lessons from the European experience. China Journal of Accounting Research, 6(4), 247-263. https://doi.org/10.1016/j.cjar.2013.08.003

Patrick, E. A., Paulinus, E. C., & Nympha, A. N. (2015). The influence of corporate governance on earnings management practices: a study of some selected quoted companies in Nigeria. American Journal of Economics, Finance, and Management, 1(5), 482-493. https://doi.org/10.1002/9781119196662.ch10

Rashid, M. M. (2020). Presence of professional accountant in the top management team and financial reporting quality. Journal of Accounting & Organizational Change, 16(2), 237-257. https://doi.org/10.1108/jaoc-12-2018-0135

Ramanna, K. and Sletten, E. (2009), “Why do countries adopt International Financial Reporting Standards?”, Working Paper No. 09-102, Accounting and Management Unit, Harvard Business School, available at: www.hbs.edu/faculty/Publication%20Files/09-102.pdf

Saha, A., Morris, R. D., & Kang, H. (2019). Disclosure overload? An empirical analysis of International Financial Reporting Standards disclosure requirements. Abacus, 55(1), 205-236.

Samaha, K., & Khlif, H. (2016). Adoption of and compliance with IFRS in developing countries. Journal of Accounting in Emerging Economies. https://doi.org/10.1108/ara-12-2014-0126

Samuel, O. L. (2014). International Financial Reporting Standard Adoption and Banks Performance in Nigeria. Social Science Research Network https://doi.org/10.2139/ssrn.2536531

Siyanbola, A. A. (2014). The Value Relevance of Accounting Information: A Study of Stock Price and Returns of Listed Deposit Money Banks in Nigeria. Masters Dissertation, School of Post Graduate, Bayero University Kano. https://doi.org/10.31580/jei.v1i3.109

Sunday, O., Wisdom, O., & Ademola, A. (2020). Financial Reporting Quality and Market Performance of Listed Deposit Money Banks (DMB) in Nigeria (2008-2017). Journal of Economics, Management and Trade, 1-10. https://doi.org/10.24940/theijbm/2020/v8/i3/bm2003-007

Suryanto, T., & Komalasari, A. (2019). Effect of mandatory adoption of international financial reporting standard (IFRS) on supply chain management: A case of Indonesian dairy industry. Uncertain Supply Chain Management, 169-178. https://doi.org/10.5267/j.uscm.2018. 10.008

Too, I. C., & Simiyu, E. (2018). Firms Characteristics and Financial Performance of General Insurance Firms in Kenya https://doi.org/10.32898/ibmj.01/1.1article27

Tracy, J. A. (2013). Accounting for Dummies (5th ed.). New Jersey: John Wiley and Sons

Türel, A. G. (2010). Timeliness of financial reporting in emerging capital markets: Evidence from Turkey. European Financial and Accounting Journal, 5(3), 113-133. https://doi.org/10.18267/j.efaj.58

Umoren, A. O., & Enang, E. R. (2015). IFRS Adoption and Value Relevance of Financial Statements of Nigerian Listed Banks. International Journal of Finance and Accounting, 4(1), 1-7. https://doi.org/10.9734/air/ 2018/42794

Umoru, H. and S. Ismail. (2010). Nigeria to Adopt International Financial Reporting standards. Vanguard 6th September p.26.

Van Beest, F., Braam, G., & Boelens, S. (2009). Quality of Financial Reporting: Measuring Qualitative Characteristics. Nijmegen Center for Economics (NiCE).Working Paper, 09-108. https://doi.org/10.1016/j.jcae.2009.03.002

Wadesango, N., & Ncube, C. (2020). Impact of quality of financial reporting on decision-making in state universities in Zimbabwe. Journal of Nation-building & Policy Studies, v4(1), 97-119. https://doi.org/10.31920/2516-3132/2020/v4n1a5